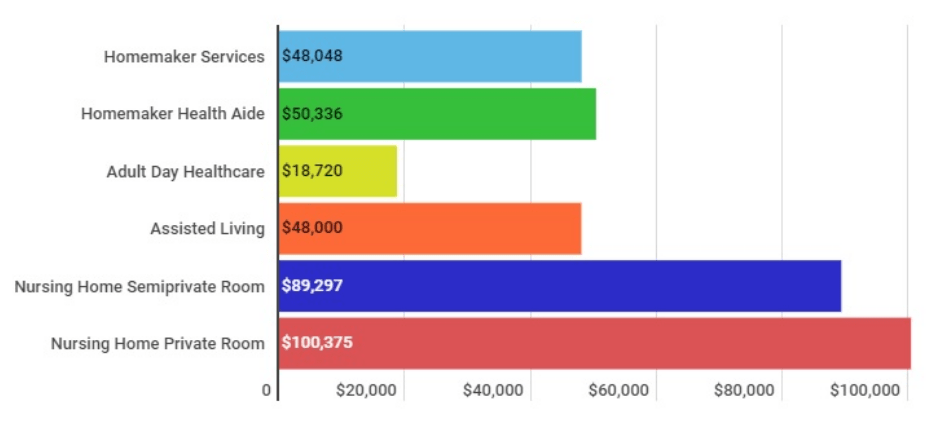

Annual Median Cost of Long-Term Care

Source: Genworth Cost of Care Survey 2018

Long Term Care

Long term care insurance is one of the fastest growing segments of the insurance industry. As the “baby boomers” approach retirement age, and they see the reality of the expense and burden of dealing with aging parents, long term care insurance is often the solution.

Long term care (LTC) insurance typically pays a daily or monthly benefit for care needed at home, at an assisted living facility, adult day care, and a nursing home. Before a benefit can be paid, often the person insured must either be unable to perform without assistance at least 2 out of 6 Activities of Daily Living. The six activities are bathing, dressing, eating, transference, continence, or toileting. Another separate trigger for benefit payments are severe cognitive impairment, such as severe dementia or Alzheimer’s.

In the absence of long term care planning, a person’s estate can be wiped out quickly due to escalating costs of this type of care.

Many people have the misconception that if they need this type of benefit that the Government will take care of it under Medicare or Medicaid. Medicare provides an extremely limited benefit for long term care expenses, and Medicaid is increasingly more difficult to qualify for.

One concern we hear from clients is the “use it or lose it” argument. In other words, if you never have a long term care expense, those premiums could be considered wasted. To solve this problem, insurance companies have incorporated long term care into new life insurance hybrid products. If you need long term care, whatever you use reduces the death benefit. If you never use the long term care, you still have the full death benefit.

Email or call us anytime to discuss your life insurance needs.